Bursting the Bubble

Challenging Traditional Narratives Using Eighteenth Century Collections Online

1. THE TIMES | Wednesday March 13 2019

2. THE TIMES | Tuesday February 12 2019

3. THE TIMES | Thursday December 3 2009

4. THE TIMES | Tuesday February 10 2009

The South Sea Company is infamous for one of the most notorious financial collapses in history, the spectre of which is raised during economic turmoil even today.

1. The swearers bank, or, Parliamentary security for a new bank, Dublin : printed by Thomas Hume, next door to the Walsh's-Head, in Smock-Alley, [1720], National Library of Scotland, N36508

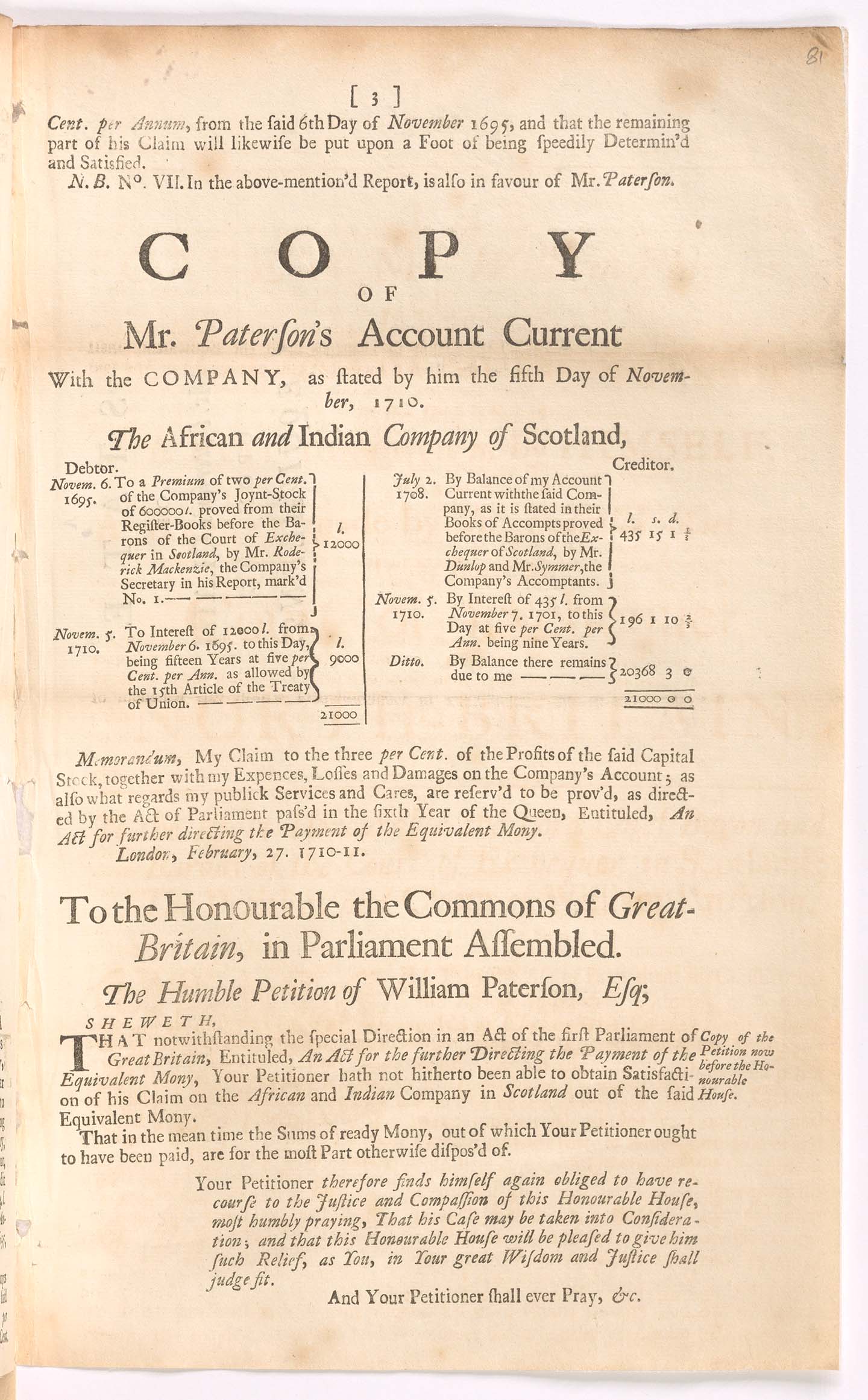

2. A state of Mr. Paterson's claim upon the equivalent, [London?, 1711], National Library of Scotland, T207938

3. Rules to be observed by all persons, that intend to be subscribers towards furnishing fifteen hundred thousand pounds to the Bank, on a subscription to be opened on Tuesday the 23d of March, 1713, [London? : s.n., 1714?], British Library, T13216

At the beginning of the eighteenth century, financial systems in Britain were undergoing a period of dramatic innovation and change.

A Scottish merchant, William Paterson, suggested that members of the public could invest in a new joint-stock company to raise the money which William III needed to fight against France, and the government would pay them interest.

This became the Bank of England.

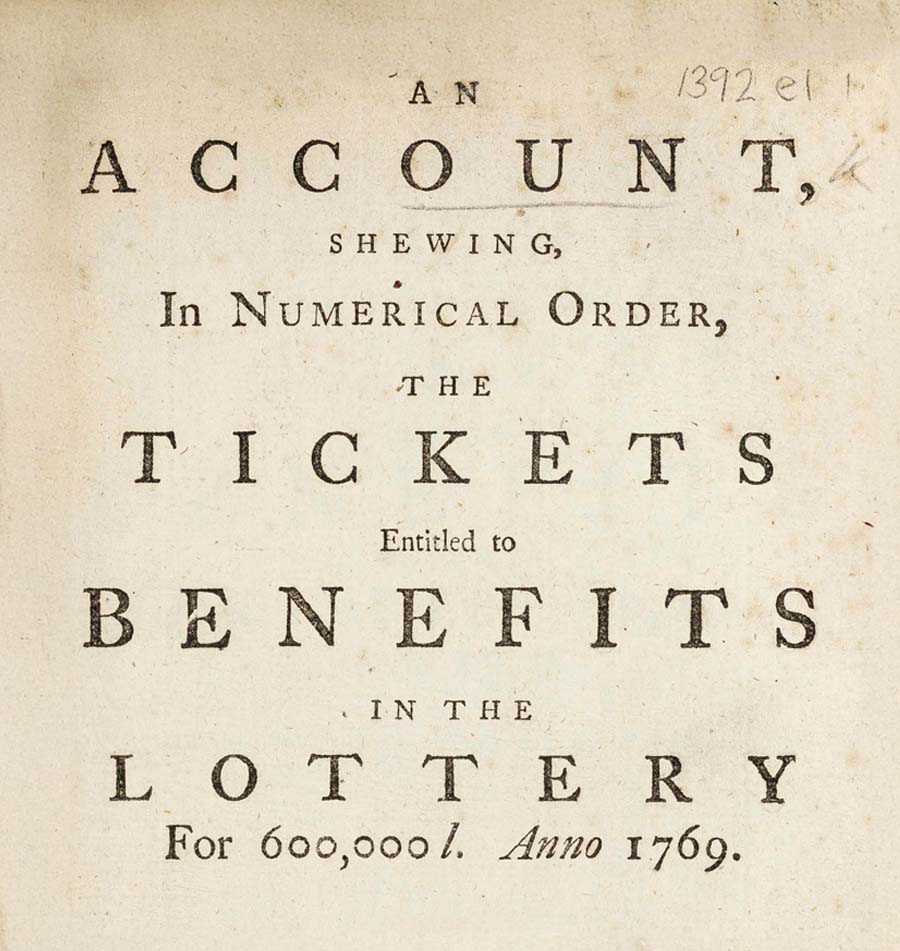

An account, shewing, in numerical order, the tickets entitled to benefits in the lottery for 600,000l. anno 1769. With the benefits to which the said tickets are entitled. Published by the special order of the managers and directors. London : printed for Thomas Lee, 1770, British Library, T86896

This led to a period of innovation and excitement around similar joint-stock companies, lotteries, annuities, insurance firms and all manner of money-making schemes.

Paterson went on to form the Africa and India Company in Scotland. ‘Exchange Alley’ in London became a popular tourist site, as well as a site of financial opportunity, and there was an increase in financial news and investments from overseas.

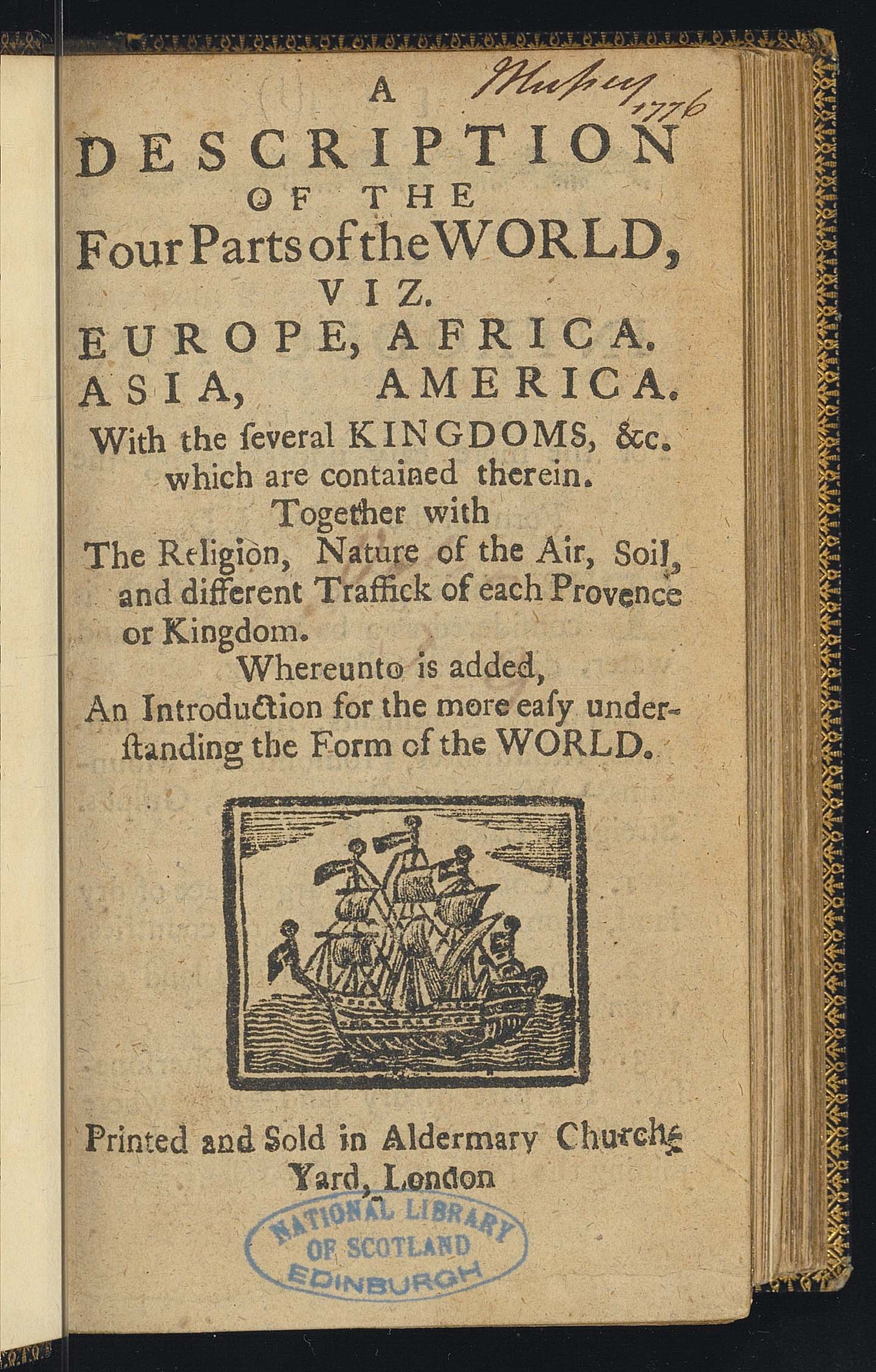

A description of the four parts of the world, viz. Europe, Africa. Asia, America. With the several kingdoms, &c. which are contained therein. Together with the religion, nature of the air, soil, and different traffick of each provence or kingdom., [London] : Printed and sold in Aldermary church-yard, London, [1776?], National Library of Scotland, T163290

A description of the four parts of the world, viz. Europe, Africa. Asia, America. With the several kingdoms, &c. which are contained therein. Together with the religion, nature of the air, soil, and different traffick of each provence or kingdom., [London] : Printed and sold in Aldermary church-yard, London, [1776?], National Library of Scotland, T163290

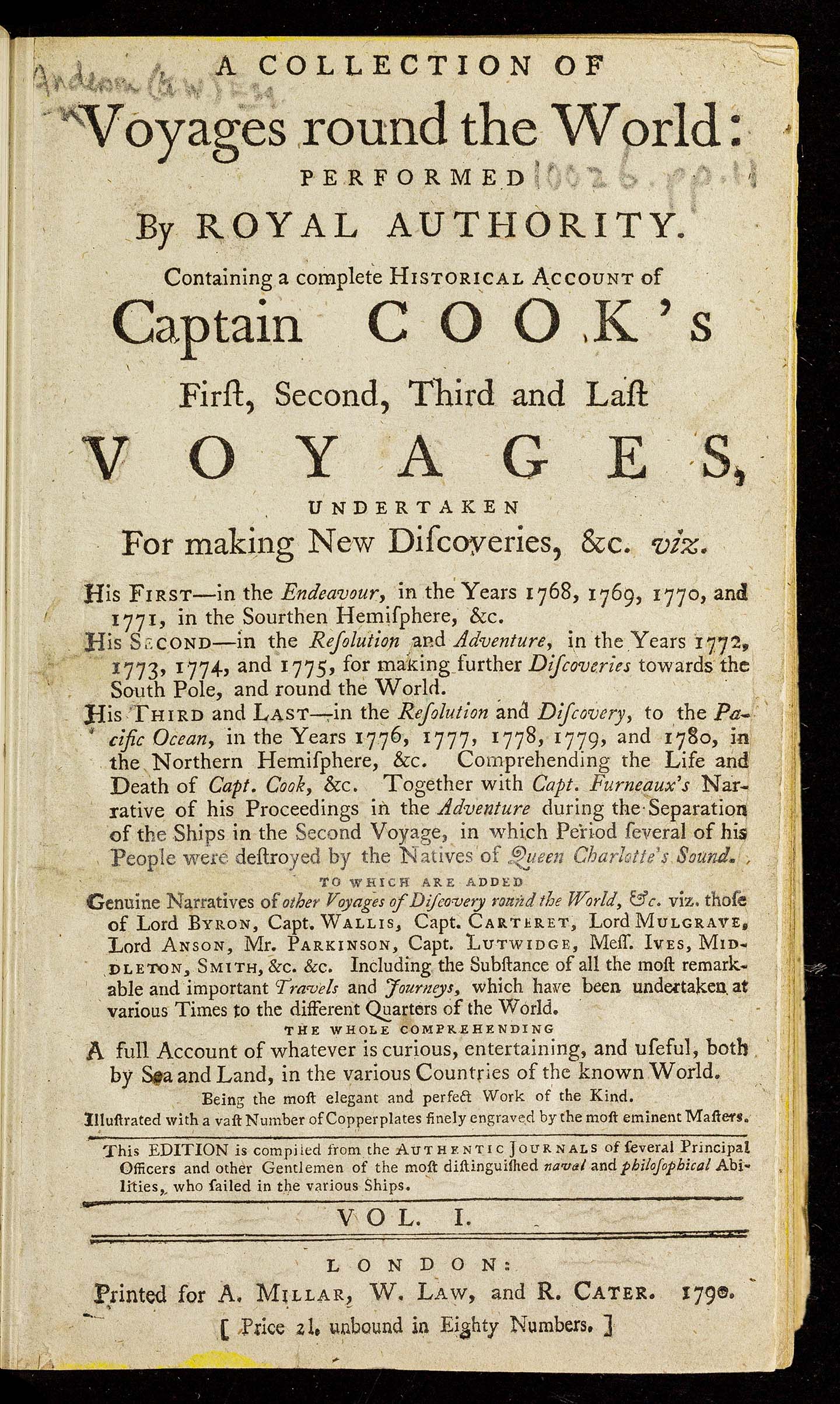

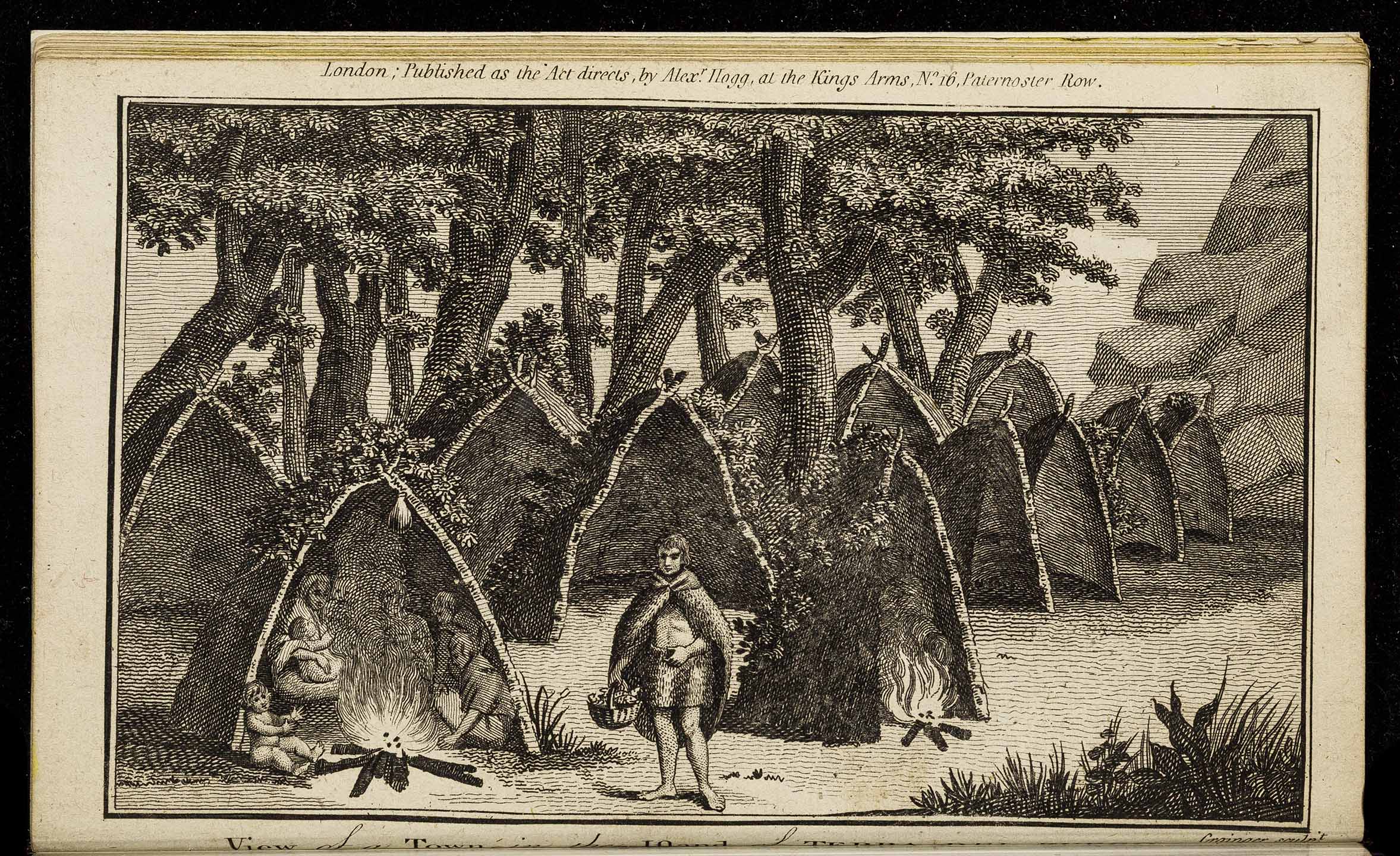

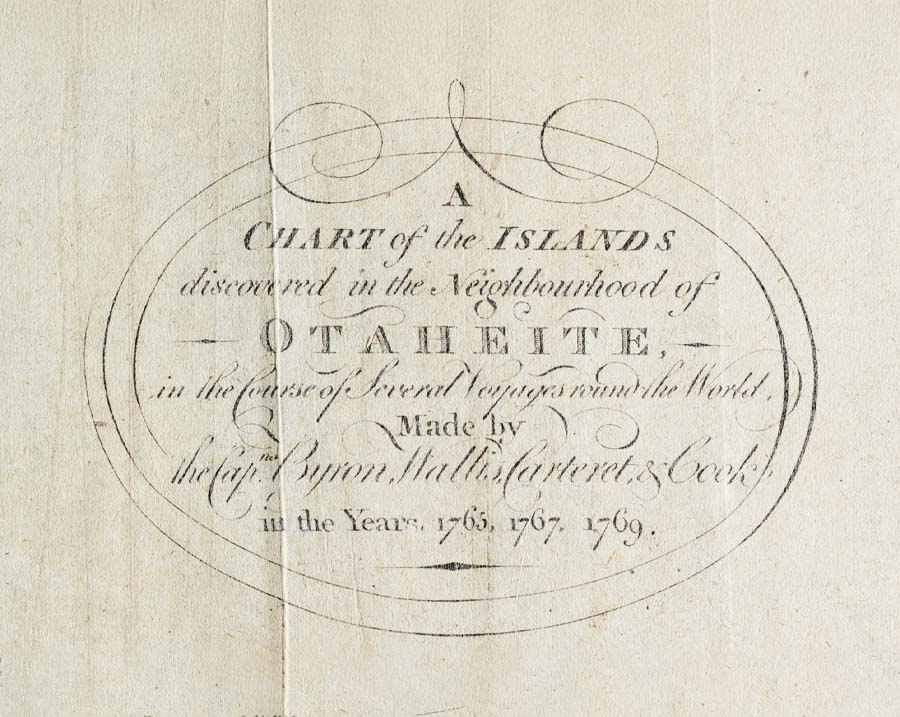

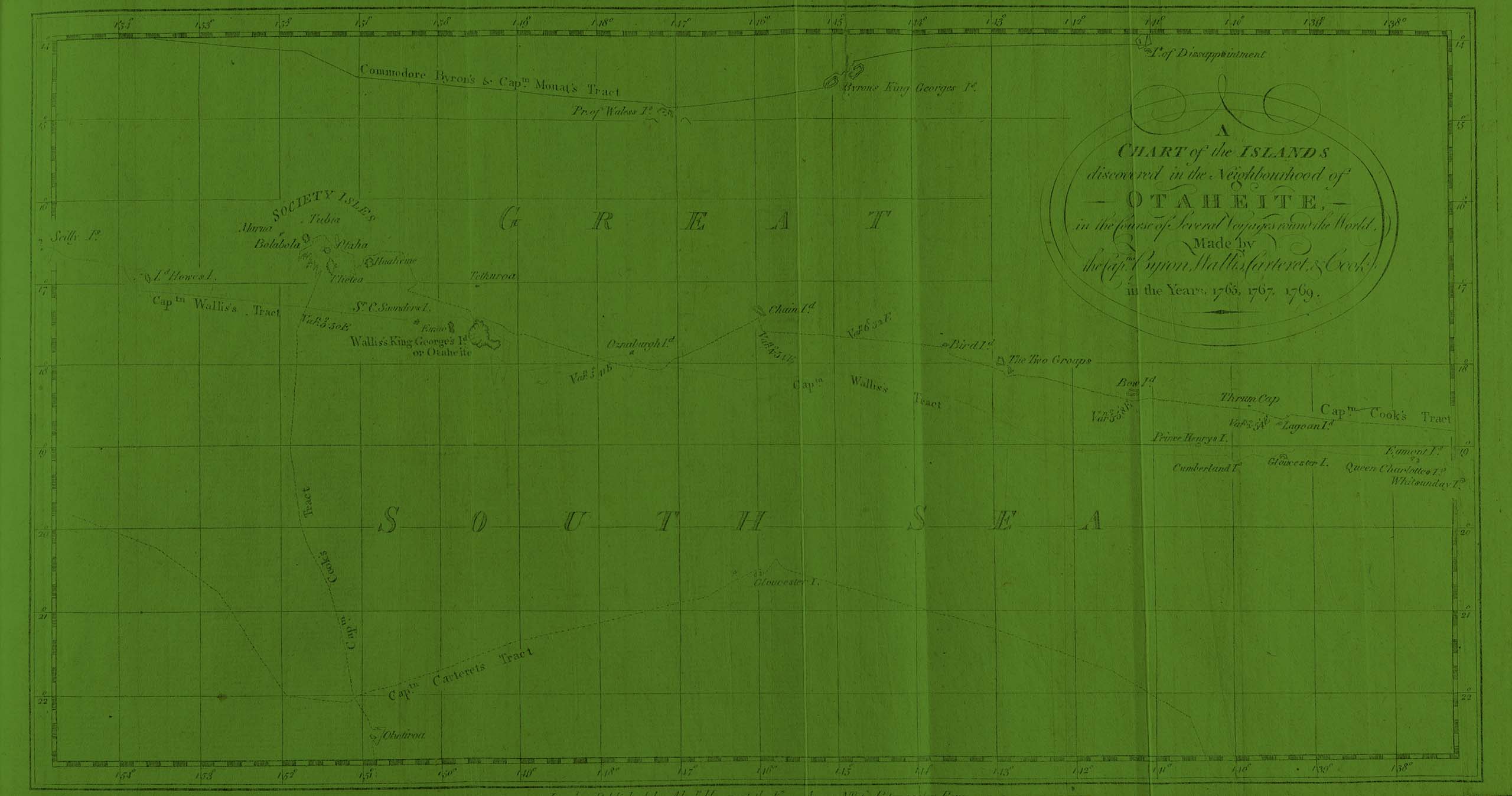

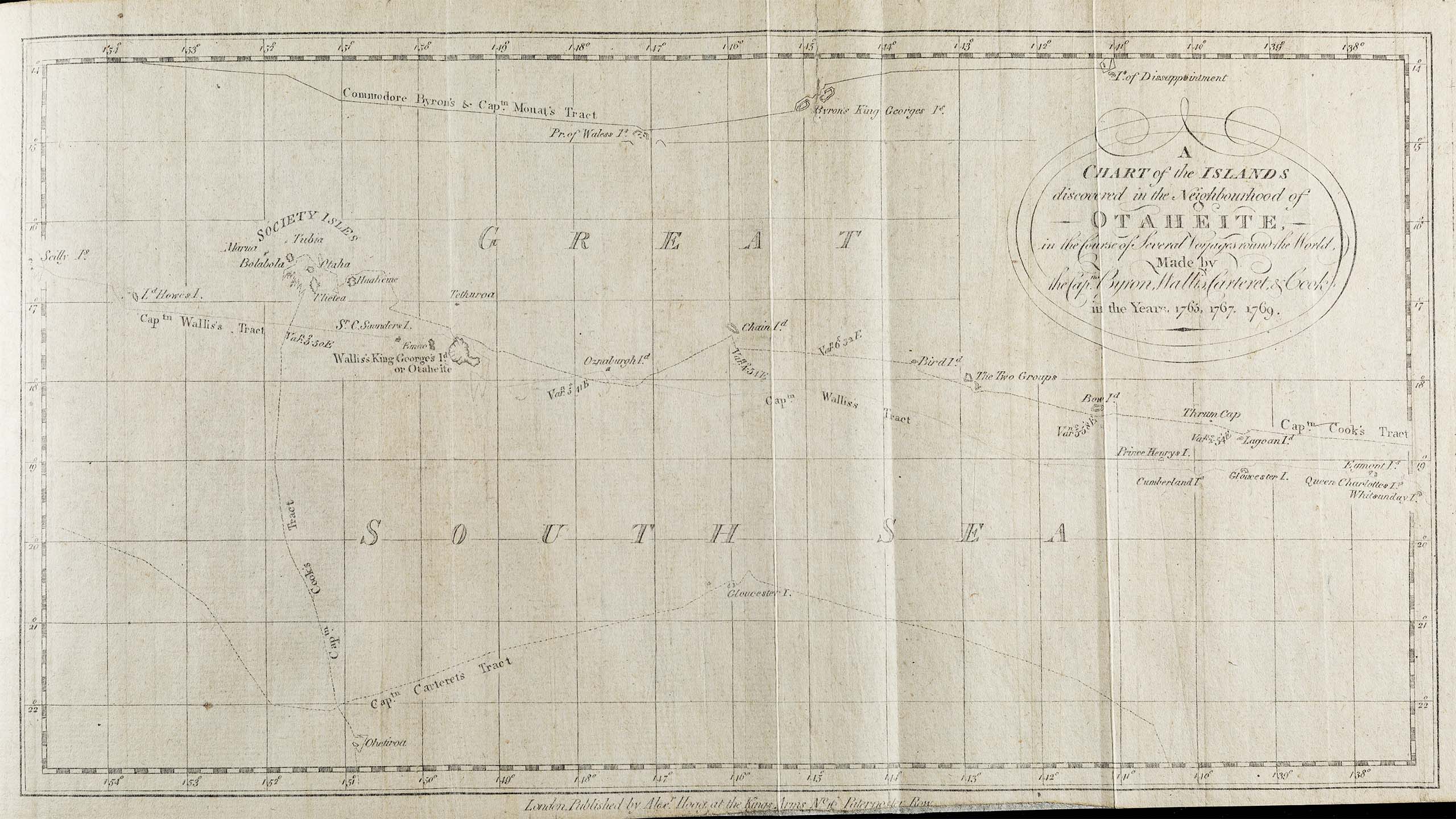

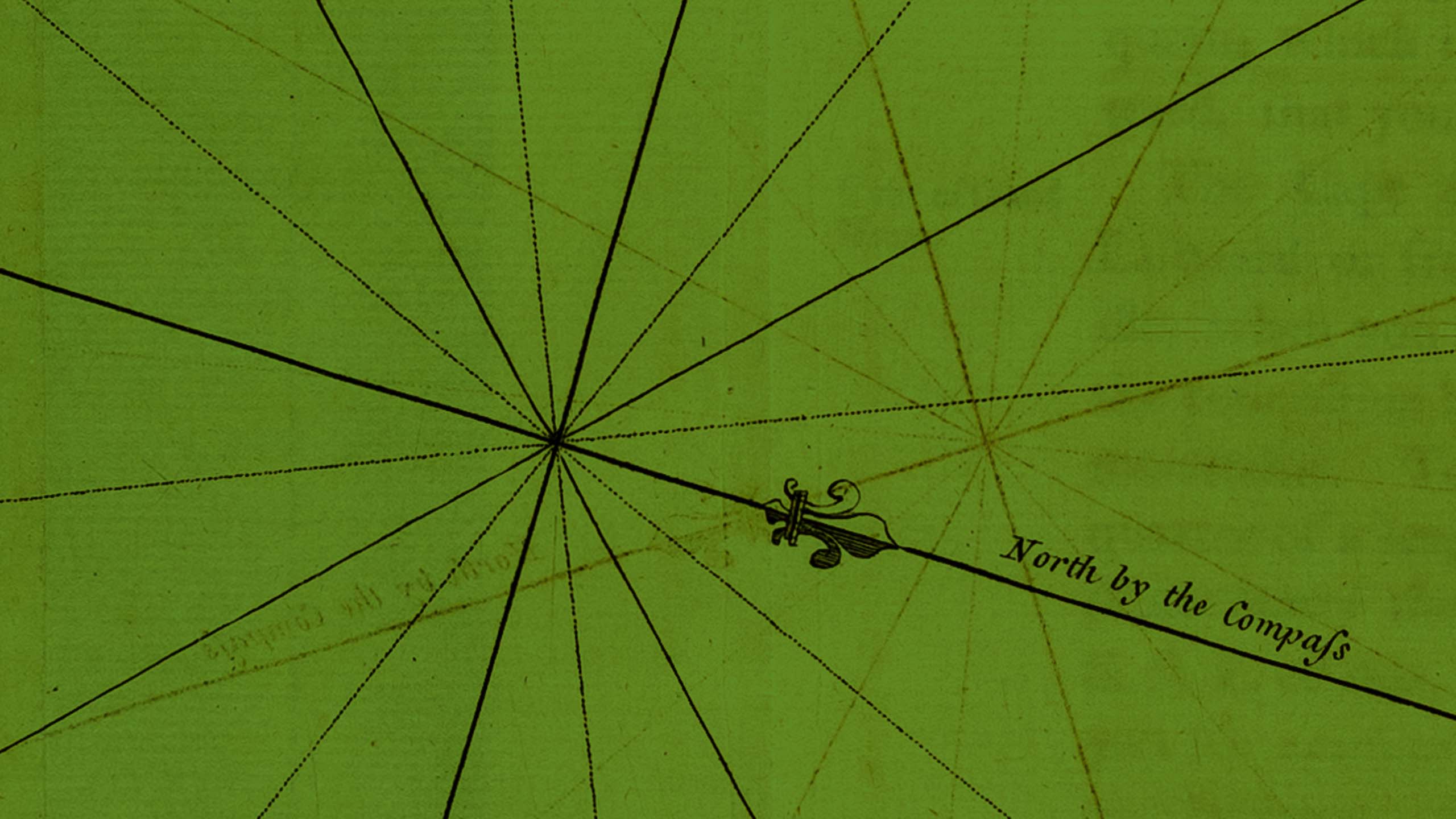

A collection of voyages round the world: performed by royal authority. Containing a complete historical account of Captain Cook's first, second, third and last voyages, undertaken for making new discoveries, &c. ... This edition is compiled from th, London [i.e. York?] : printed for A. Millar, W. Law, and R. Cater, 1790. British Library, T133820

A collection of voyages round the world: performed by royal authority. Containing a complete historical account of Captain Cook's first, second, third and last voyages, undertaken for making new discoveries, &c. ... This edition is compiled from th, London [i.e. York?] : printed for A. Millar, W. Law, and R. Cater, 1790. British Library, T133820

A collection of voyages round the world: performed by royal authority. Containing a complete historical account of Captain Cook's first, second, third and last voyages, undertaken for making new discoveries, &c. ... This edition is compiled from th, London, 1790. British Library, T133820

A collection of voyages round the world: performed by royal authority. Containing a complete historical account of Captain Cook's first, second, third and last voyages, undertaken for making new discoveries, &c. ... This edition is compiled from th, London, 1790. British Library, T133820

A description of the four parts of the world, viz. Europe, Africa. Asia, America. With the several kingdoms, &c. which are contained therein. Together with the religion, nature of the air, soil, and different traffick of each provence or kingdom, [London] : Printed and sold in Aldermary church-yard, London, [1776?], National Library of Scotland, T163290

The eighteenth century was also a time of exploration, entrepreneurship and colonialism. Britain expanded its influence and control in territories across the globe, including Australia, India and the Pacific Ocean.

Much of this expansion and exploitation was through joint stock companies such as the East India Company, which enlarged its presence in India from coastal trading posts to military rule during this period.

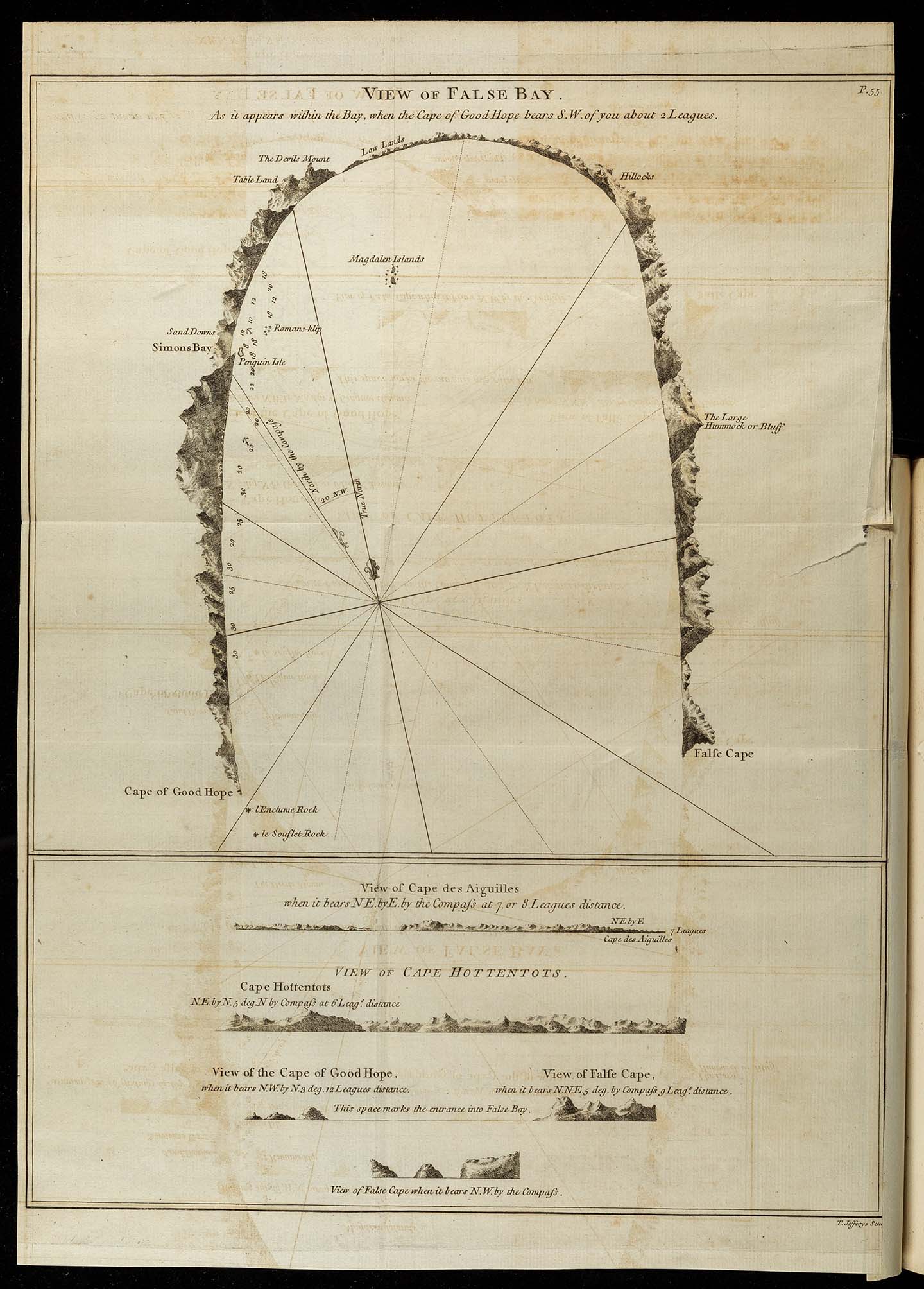

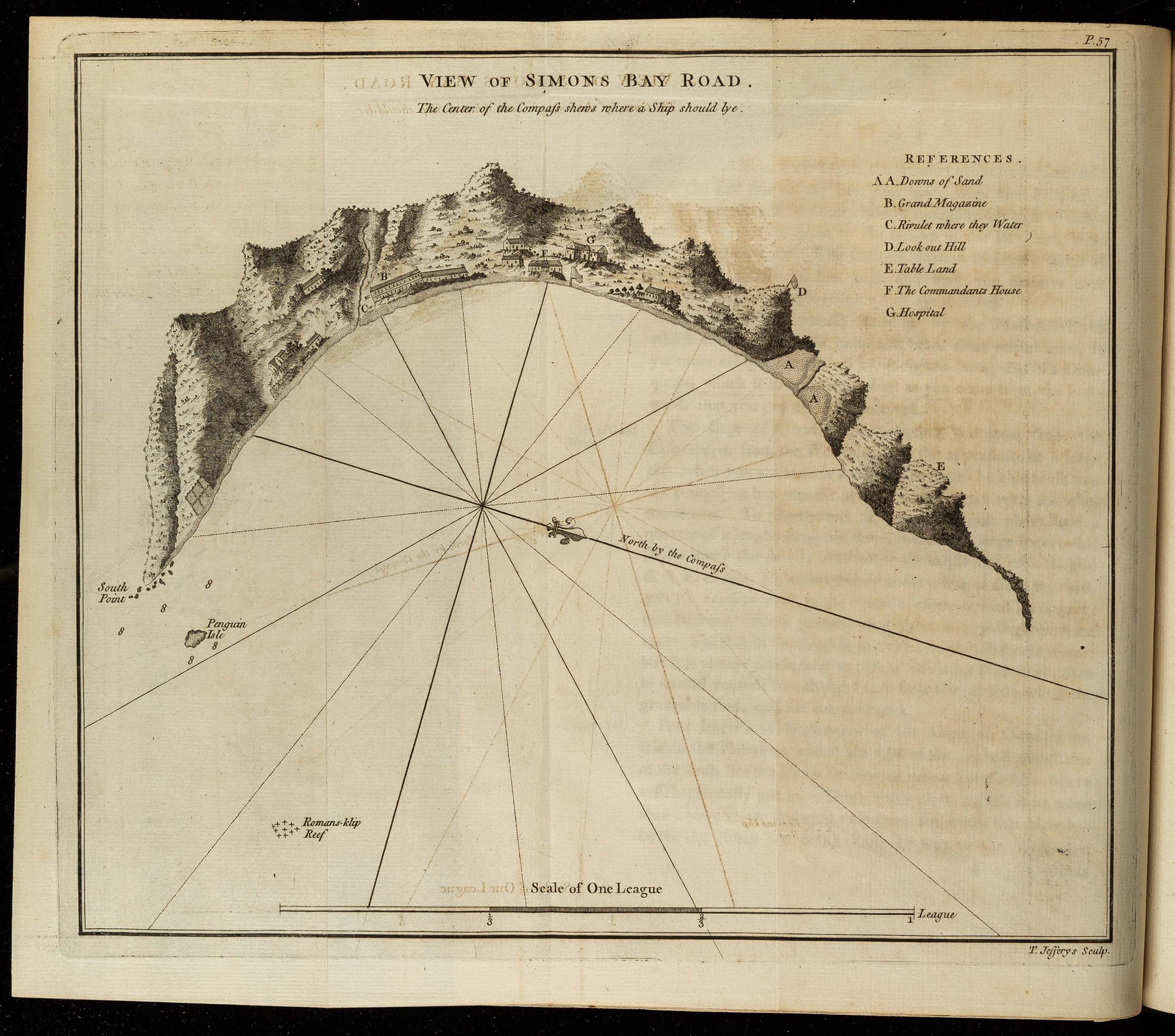

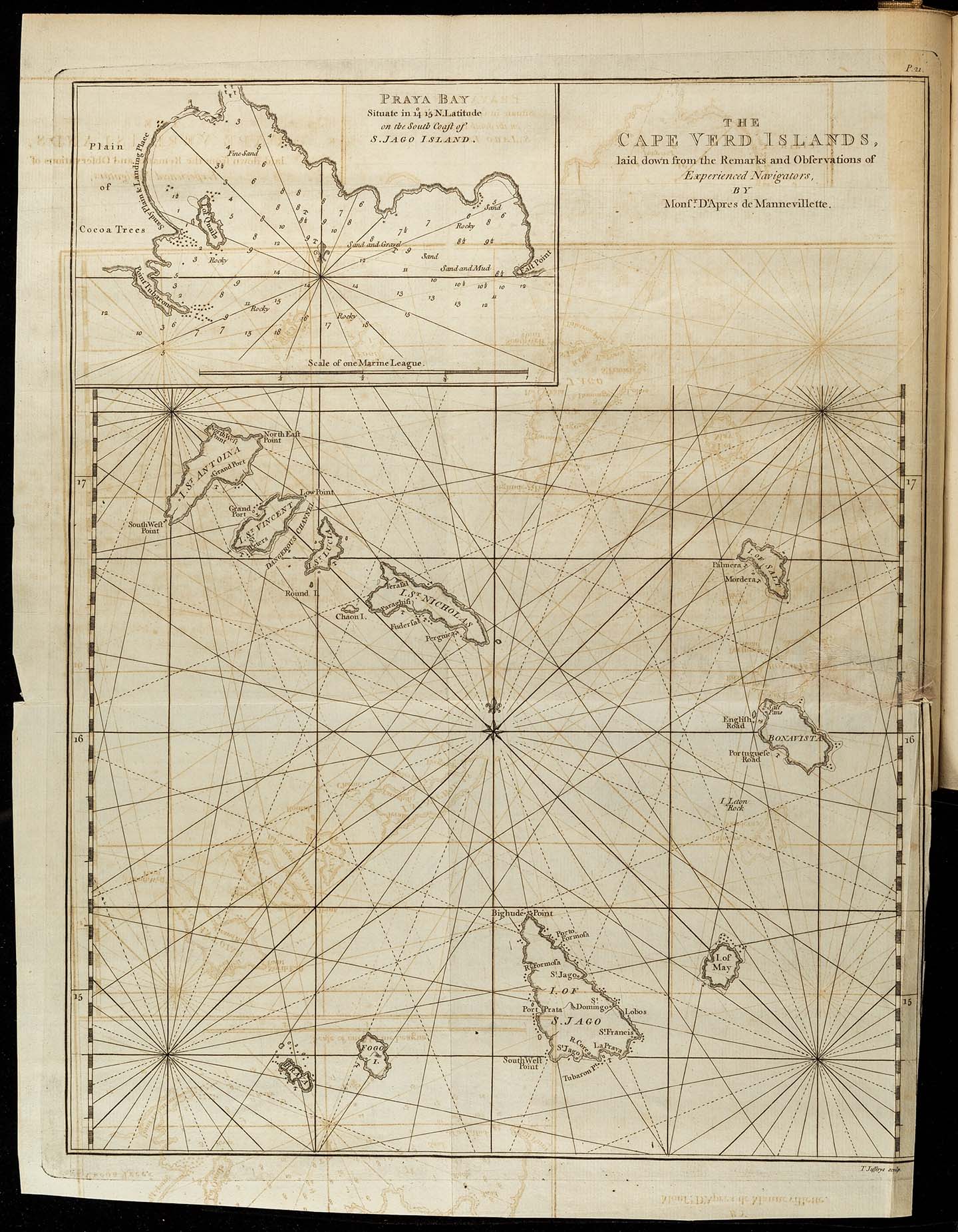

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys, London : printed for the editor; and sold by Mr. Gregory, 1769. British Library, T214224

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys, London : printed for the editor; and sold by Mr. Gregory, 1769. British Library, T214224

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys,, London : printed for the editor; and sold by Mr. Gregory, 1769., British Library, T214225

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys,, London : printed for the editor; and sold by Mr. Gregory, 1769., British Library, T214225

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys,, London : printed for the editor; and sold by Mr. Gregory, 1769., British Library, T214226

Directions for navigating from the Channel to the East Indies. Translated from Mons. d'Apres de Mannevillette's Memoire sur la navigation de France aux Indes. Illustrated with a chart and plans, engraved by Thomas Jefferys,, London : printed for the editor; and sold by Mr. Gregory, 1769., British Library, T214226

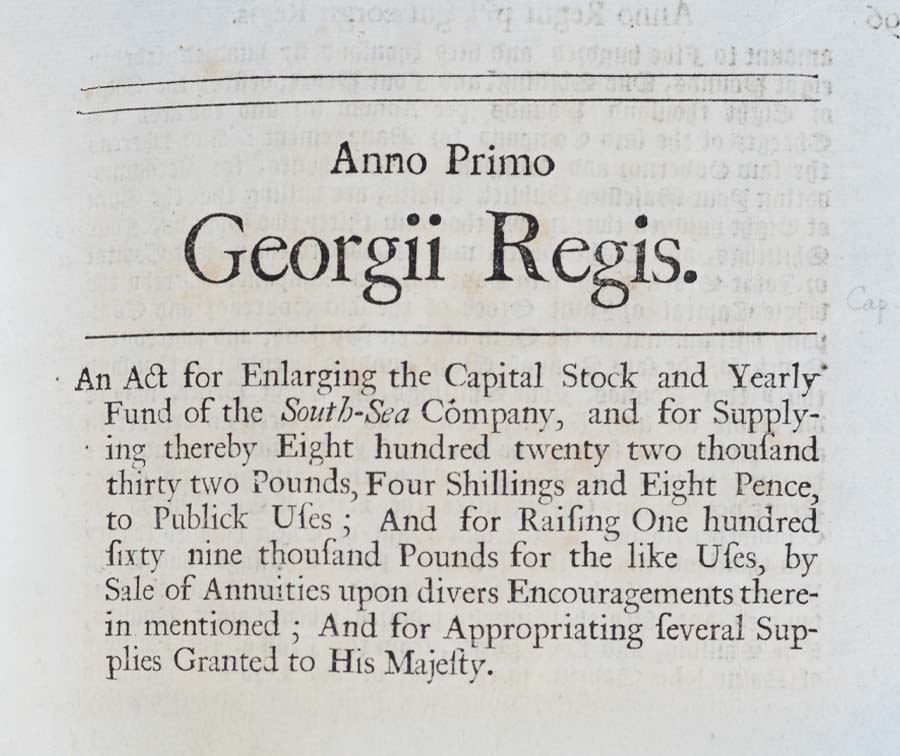

An Act for enlarging the capital stock and yearly fund of the South-Sea Company, and for supplying thereby eight hundred twenty two thousand thirty two pounds, four shillings and eight pence, to publick uses; and for raising one hundred sixty nine thousand pounds for the like uses, by sale of annuities upon divers encouragements therein mentioned; and for appropriating several supplies granted to His Majesty, [London: printed by John Baskett, and by the assigns of Thomas Newcomb, and Henry Hills, deceas'd, 1715], Senate House, N53675

These historical themes converged in the creation of the South Sea Company, a British joint-stock company that was established in 1711 and aimed to engage in trade and commerce with Spanish colonies in South America.

In this period the term “south seas” referred to South America and its surrounding waters.

The company's main objective was to convert the national debt of England into company shares, offering investors the opportunity to profit from the potential wealth generated by trade with the Spanish and Portuguese colonies in the region.

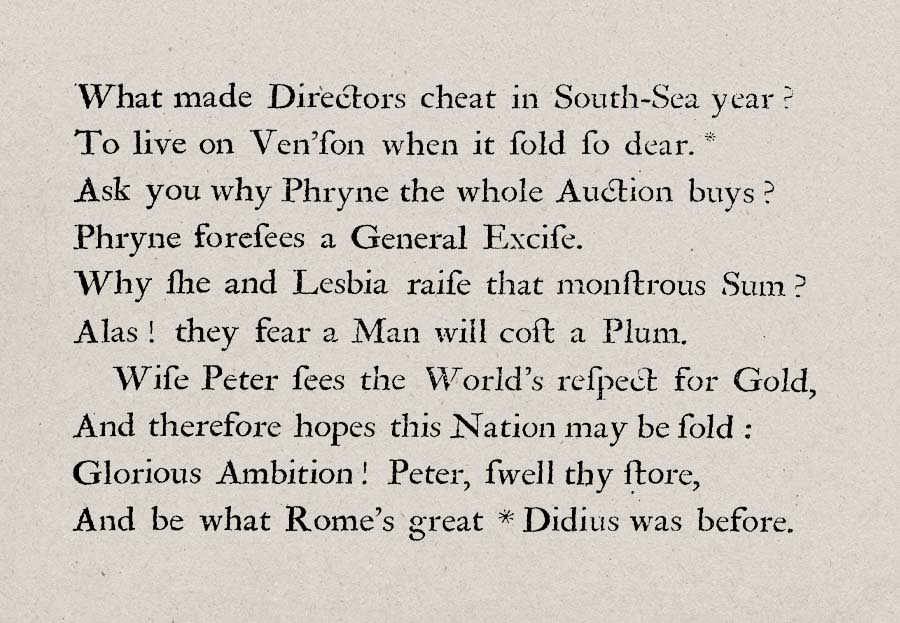

Of the use of riches, an epistle to the Right Honorable Allen Lord Bathurst. By Mr. Pope, London : printed by J. Wright, for Lawton Gilliver at Homer's Head against St. Dunstan's Church in Fleetstreet, [1732] [1733]. British Library, T5712

The South Sea Company gained significant popularity among investors due to the promise of high returns and the speculative frenzy surrounding its stock.

In 1720, investors began to realize the company's lack of profitability and unsustainable practices.

Panic ensued, leading to a massive stock market crash.

Many investors lost substantial amounts of money, but those who were well-connected – particularly to the king – were shielded from the losses.

Myth making

A collection of voyages round the world: performed by royal authority. Containing a complete historical account of Captain Cook's first, second, third and last voyages, undertaken for making new discoveries, &c. ... This edition is compiled from th, London, 1790, British Library, T133820

In the popular imagination, the story of the South Sea bubble is often one of greed and foolish speculation, erroneously located in the southern Pacific Ocean.

This is due in large part to the outpouring of criticism of the scheme in the booming print culture of the eighteenth century.

1. The Fatal Sickness, Death and Burial, [Edinburgh] : London printed, and Edinburgh re-printed in year, 1721, National Library of Scotland, T190902

2. The old tur-p-man's hue-and-cry after more money: or, two bunches of turnips for a penny, [London?, 1720?], British Library, T10400

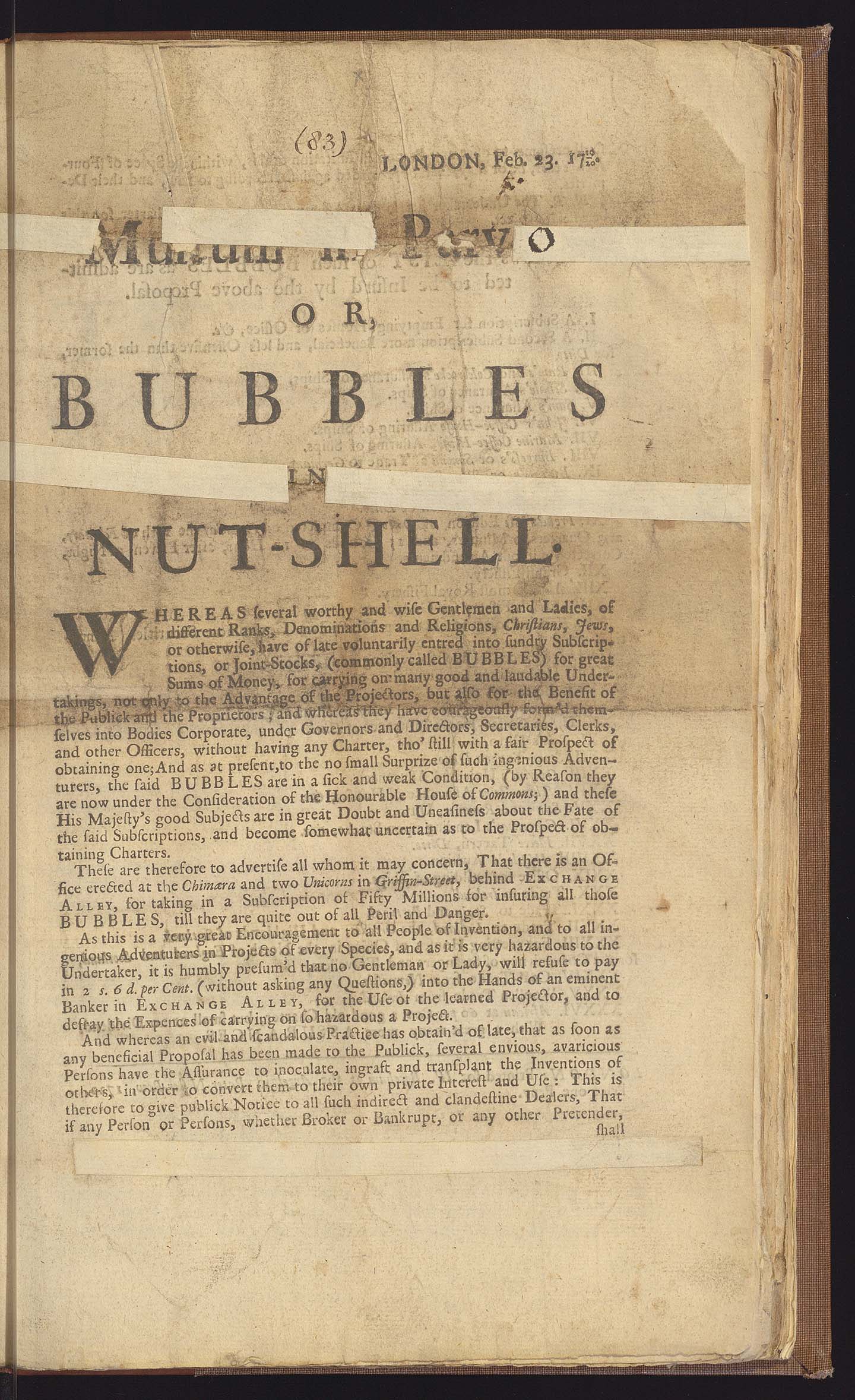

3. Multum in parvo; or, Bubbles in a nut-shell, [London: Printed for W. Boreham at the Angel in Pater-Noster-Row, 1720], National Library of Scotland, N471397

4. A state of Mr. Patersons claim upon the equivalent, [London?, 1711], National Library of Scotland, T207938

5. South Sea corruption by a gentleman of Grays-Inn, London: printed in the year, 1721, National Library of Scotland, T160380

Accounts of the ‘Bubble’ proliferated in pamphlets, broadsheets and other formal and informal literary genres.

The records of the South Sea Company have not survived, and so pamphlets and broadsides, which naturally lean towards hyperbole, have an outsize contribution to the understanding of the crisis.

Multum in parvo; or, Bubbles in a nut-shell, [London: Printed for W. Boreham at the Angel in Pater-Noster-Row, 1720], National Library of Scotland, N471397

Multum in parvo; or, Bubbles in a nut-shell, [London: Printed for W. Boreham at the Angel in Pater-Noster-Row, 1720], National Library of Scotland, N471397

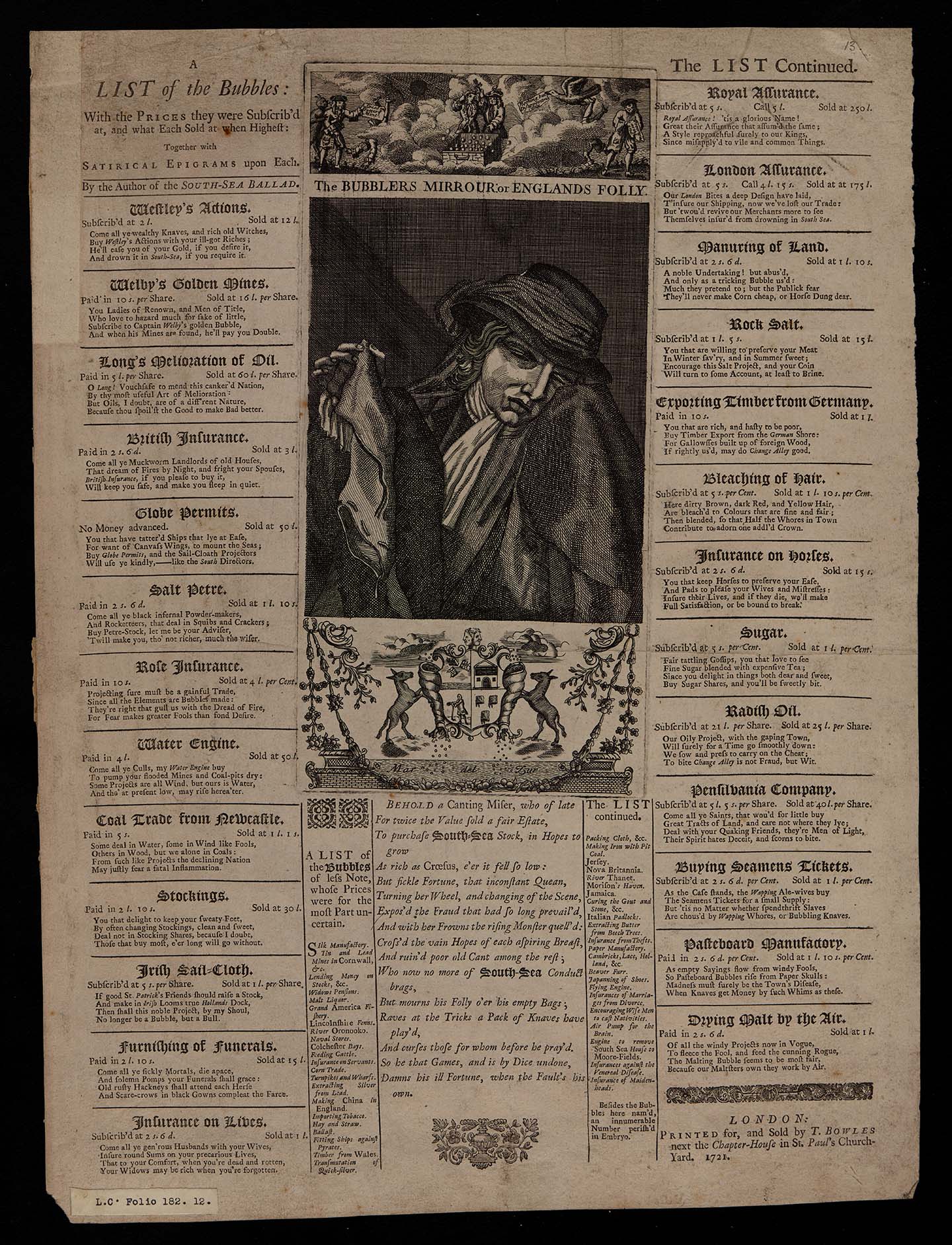

A list of the bubbles: with the prices they were subscrib'd at, and what each sold at when highest: together with satirical epigrams upon each. By the author of the South-Sea ballad. National Library of Scotland, T196218

A list of the bubbles: with the prices they were subscrib'd at, and what each sold at when highest: together with satirical epigrams upon each. By the author of the South-Sea ballad. National Library of Scotland, T196218

A state of Mr. Patersons claim upon the equivalent, [London?, 1711]. National Library of Scotland, T207938

A state of Mr. Patersons claim upon the equivalent, [London?, 1711]. National Library of Scotland, T207938

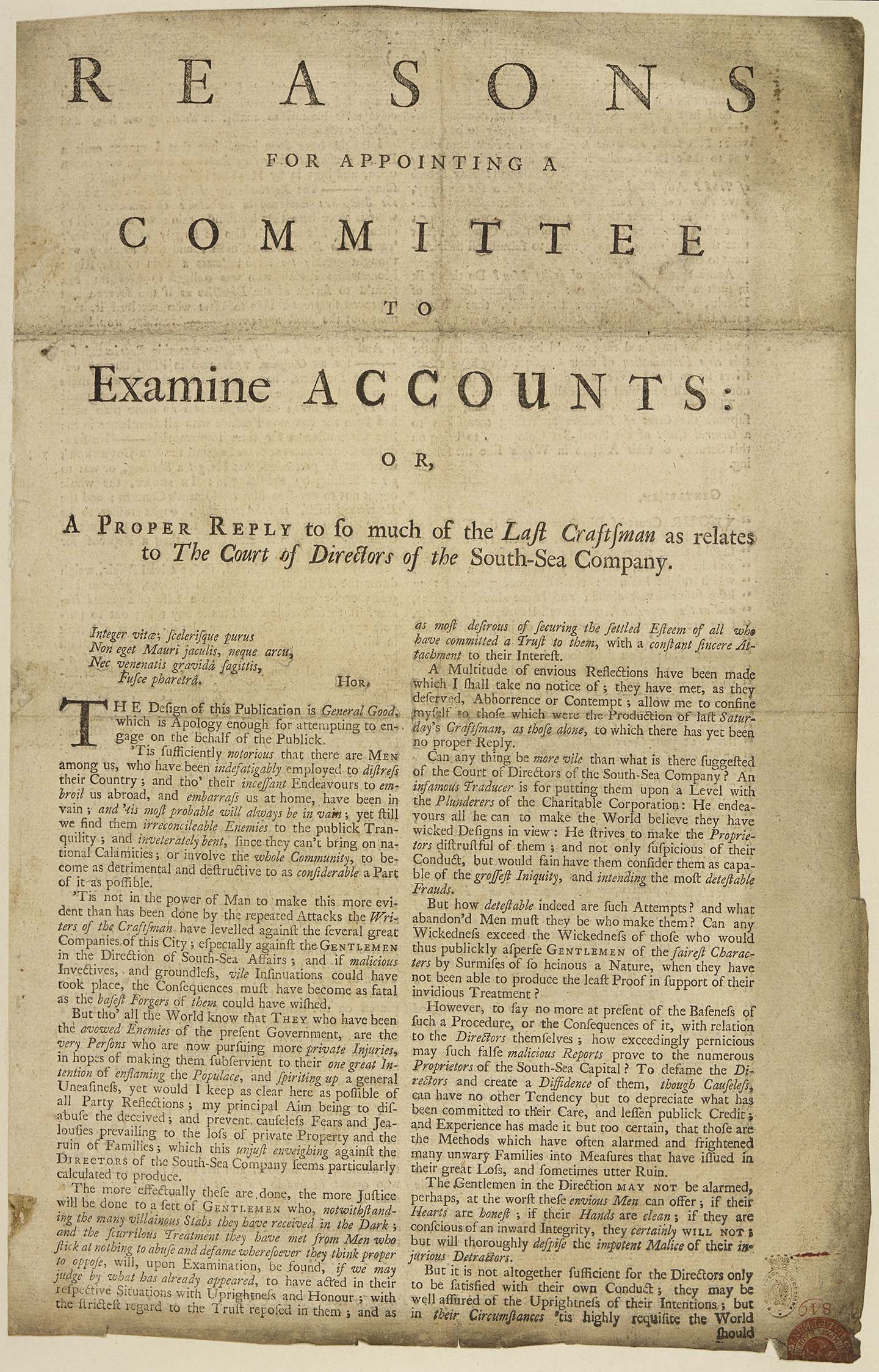

Reasons for appointing a committee to examine accounts: or, a proper reply to so much of the last Craftsman as relates to the court of directors of the South-Sea Company, [London]: printed for T. Warner, at the Black-Boy in Pater-noster Row, MDCCXXXII. [1732], National Library of Scotland, T170028

Reasons for appointing a committee to examine accounts: or, a proper reply to so much of the last Craftsman as relates to the court of directors of the South-Sea Company, [London]: printed for T. Warner, at the Black-Boy in Pater-noster Row, MDCCXXXII. [1732], National Library of Scotland, T170028

Sentiment analysis, South Sea scheme, 1700-1950

◉ Sentiment Score

Sentiment Analysis, South Sea Bubble, 1700-1950, Gale Digital Scholar Lab

We possibly see the effect of this skewing in the sources with an increasingly negative view of the crisis over time.

A sentiment analysis from the Gale Digital Scholar Lab shows that the South Sea Bubble was referenced more frequently, and more negatively, in the nineteenth century than the eighteenth.

What Eighteenth Century Collections Online tells us

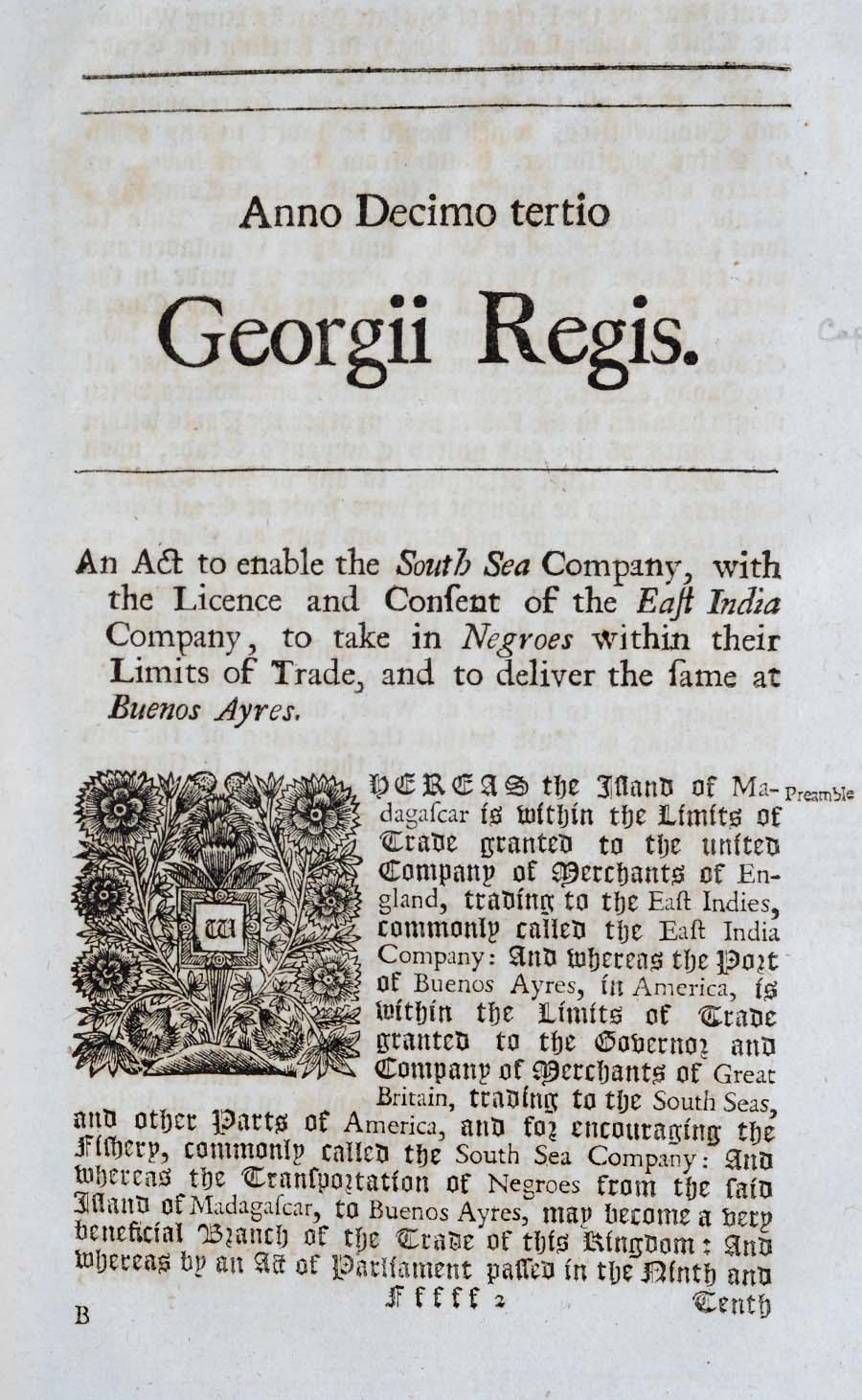

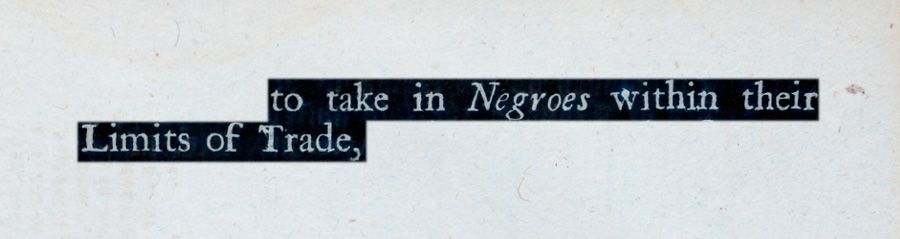

An Act to enable the South Sea Company, with the licence and consent of the East India Company, to take in Negroes within their limits of trade, and to deliver the same at Buenos Ayres, [London: printed by John Baskett; and Thomas Norris, assignee to George Hills, 1727], Senate House, N50315

Eighteenth Century Collections Online (ECCO) allows us to look across a vast number of pages to explore the nuanced themes that emerge from published works about the South Sea Company.

As a significant example, the South Sea Company did not cease trading in 1720, as this Act from 1727 shows.

Far from being an empty pyramid scheme, the South Sea Company was a legitimate business, whose trading activities continued after its stock price collapsed.

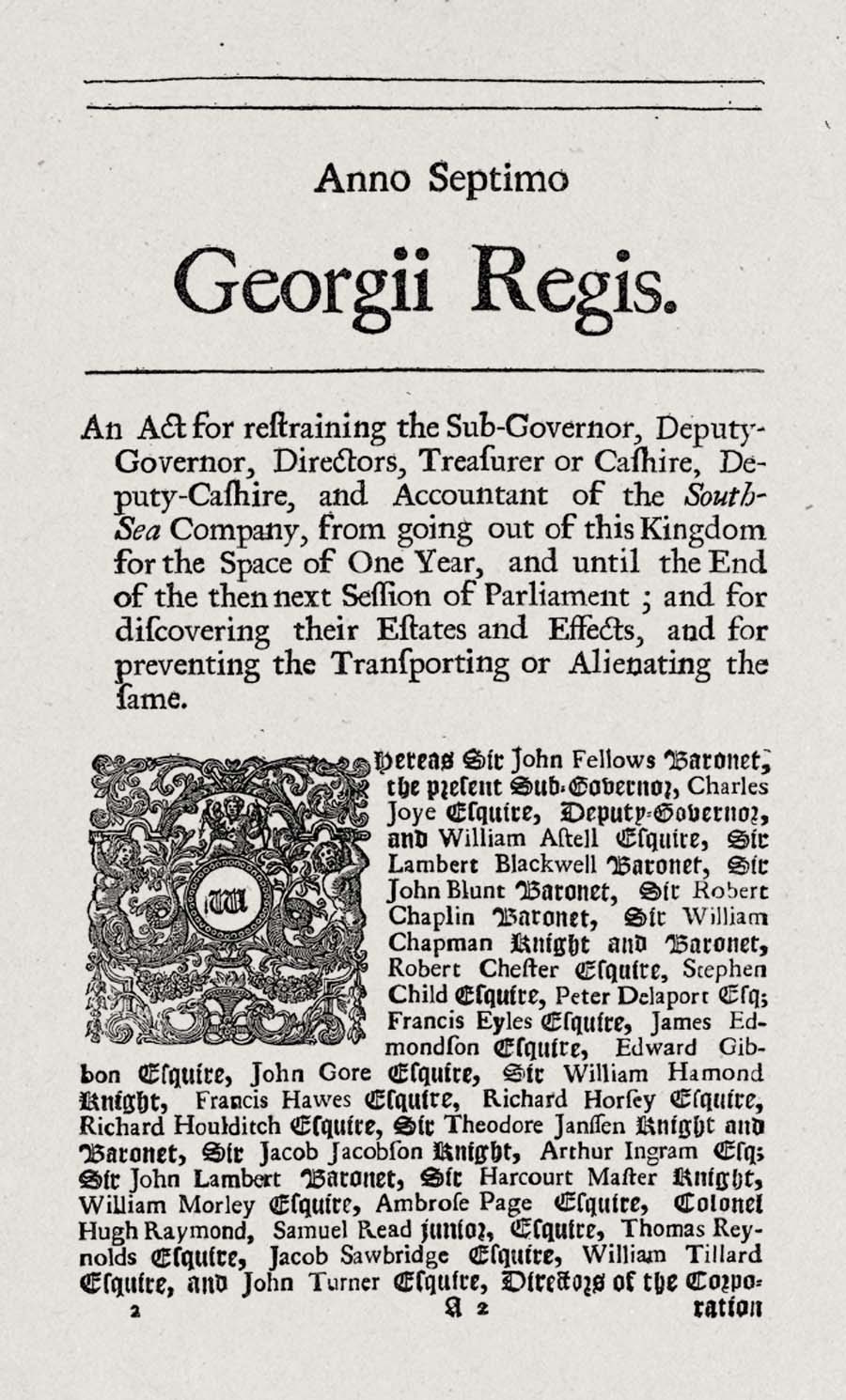

After a swell of public opinion against those involved in the crash there was a parliamentary inquiry established, which uncovered evidence of insider trading and bribery.

Several company directors were punished, including prominent Cabinet members. They were impeached and had their estates confiscated to remunerate investors.

A list of the bubbles: with the prices they were subscrib'd at, and what each sold at when highest: together with satirical epigrams upon each. By the author of the South-Sea ballad. National Library of Scotland, T196218

Further, the South Sea Company was not the only bubble that ‘popped’ during this time.

Eighteenth century opprobrium was directed towards these new financial models in general, with suspicion regarding the social mobility they promised, and an upturning of traditional societal hierarchies.

Digging deeper

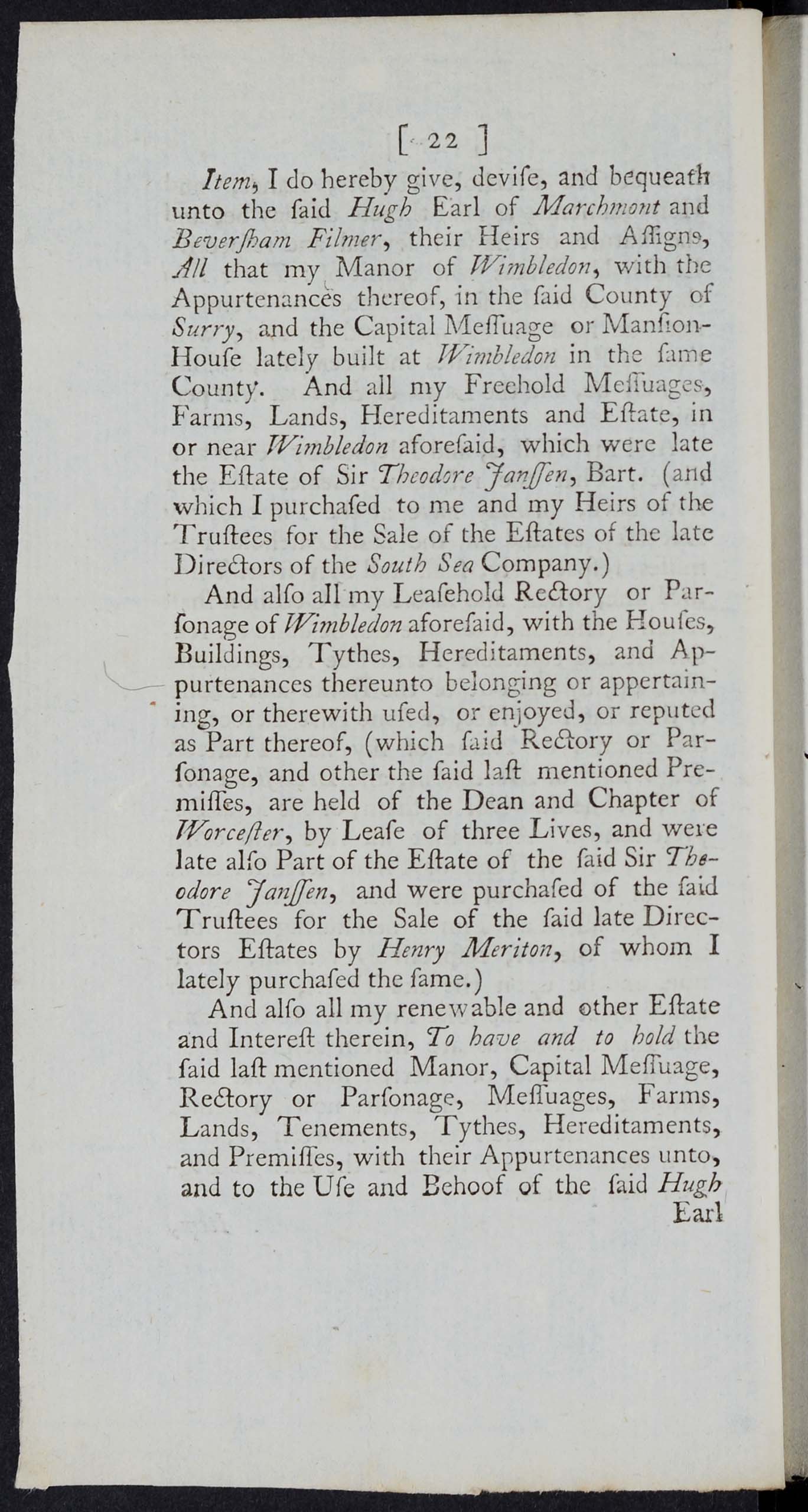

Authentick memoirs of the life and conduct of Her Grace, Sarah, late Dutchess of Marlborough : containing a genuine narrative of Her Grace's conduct, from her first coming to court, to the death of her royal mistress Queen Anne, and from the demise of the Queen to Her Grace's death : likewise, all Her Grace's letters to the Queen, and her Majesty's answers : to which is prefixed, The last will and testament of Her Grace, from a true copy of the original, lodg'd in Doctors Commons. London. 1744, UCL, N30666

One particular concern was the ability of women to invest in these schemes. Sources show that up to twenty percent of investors in the South Sea Company were women.The Duchess of Marlborough is one such example – though she foresaw the collapse of the stock price and avoided losses. In her will, she bequeathed several estates that she had purchased from the directors of the South Sea Company in 1721.

Authentick memoirs of the life and conduct of Her Grace, Sarah, late Dutchess of Marlborough : containing a genuine narrative of Her Grace's conduct, from her first coming to court, to the death of her royal mistress Queen Anne, and from the demise of the Queen to Her Grace's death : likewise, all Her Grace's letters to the Queen, and her Majesty's answers : to which is prefixed, The last will and testament of Her Grace, from a true copy of the original, lodg'd in Doctors Commons. London. 1744, UCL, N30666

Authentick memoirs of the life and conduct of Her Grace, Sarah, late Dutchess of Marlborough : containing a genuine narrative of Her Grace's conduct, from her first coming to court, to the death of her royal mistress Queen Anne, and from the demise of the Queen to Her Grace's death : likewise, all Her Grace's letters to the Queen, and her Majesty's answers : to which is prefixed, The last will and testament of Her Grace, from a true copy of the original, lodg'd in Doctors Commons. London. 1744, UCL, N30666

Authentick memoirs of the life and conduct of Her Grace, Sarah, late Dutchess of Marlborough : containing a genuine narrative of Her Grace's conduct, from her first coming to court, to the death of her royal mistress Queen Anne, and from the demise of the Queen to Her Grace's death : likewise, all Her Grace's letters to the Queen, and her Majesty's answers : to which is prefixed, The last will and testament of Her Grace, from a true copy of the original, lodg'd in Doctors Commons. London. 1744, UCL, N30666

Authentick memoirs of the life and conduct of Her Grace, Sarah, late Dutchess of Marlborough : containing a genuine narrative of Her Grace's conduct, from her first coming to court, to the death of her royal mistress Queen Anne, and from the demise of the Queen to Her Grace's death : likewise, all Her Grace's letters to the Queen, and her Majesty's answers : to which is prefixed, The last will and testament of Her Grace, from a true copy of the original, lodg'd in Doctors Commons. London. 1744, UCL, N30666

The bubblers bubbled, or the devil take the hindmost, [Northampton] : Cut and printed at Northampton, where country shop-keepers and others may be furnish'd with all sorts of broad-sheets, ballads, and histories, as cheap, and much better done than at any printing-office in England, MDCCXX. [1720], British Library, T142941

Investments such as the South Sea Company came to be presented as feminine, emphasising volatility and unpredictability, and their potential to disrupt social hierarchies.

In The bubblers bubbled, or the devil take the hindmost, we see the figure of Plenty, with bared breasts, throwing out investment opportunities from above the heads of the investors.

The rise and fall of stocks, 1720. An epistle to the Right Honourable my Lord Ramsay, now in Paris. To which is added the satyr's comick project for recovering a bankrupt stockjobber, National Library of Scotland, T169658

Literary sources from ECCO can also offer us alternative perspectives.

The Scottish poet Allan Ramsay wrote multiple poems on the South Sea Bubble which can be examined through ECCO and offer an interesting comparison to the alarmist puffery of the pamphlet literature.

In The Rise and Fall of Stocks Ramsay describes the upheaval of the bubble but is generally optimistic in tone: “a glorious sun shall soon arise, to brighten up Britannia’s skies.”

He sees the bubble as a temporary period of foolishness and that “Britons shall smile at follies past.”

Newman, Steve. “Second-sighted Scot: Allan Ramsay and the South Sea Bubble.”

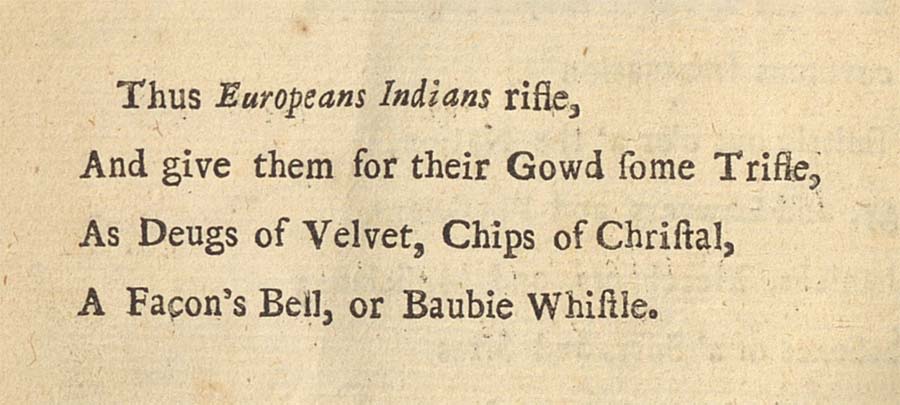

In the same poem Ramsay compares victims of the crash to “Indians”, considering them both to have been deceived.

His Scottish perspective, coming from the junior partner in the newly created union, helps him to contemplate the fate of Indigenous people, a consideration which is missing from other contemporary sources. Ramsay’s less Anglo-centric point of view gives a more balanced picture of events.

Looking for the invisible

A list of the bubbles: with the prices they were subscrib'd at, and what each sold at when highest: together with satirical epigrams upon each. By the author of the South-Sea ballad., National Library of Scotland , T196218

It’s also important to note what is absent from the pamphlet literature regarding the South Sea crisis. The pamphlets focus overwhelmingly on the white, male ‘victims’ of the scheme.

There is no apparent consideration of the trade in which the company was engaged – that of enslaved Africans.

An Act to enable the South Sea Company, with the licence and consent of the East India Company, to take in Negroes within their limits of trade, and to deliver the same at Buenos Ayres, [London: printed by John Baskett; and Thomas Norris, assignee to George Hills, 1727], Senate House, N50315

In 1713, Britain secured the rights to supply slaves to Spanish America as part of the Treaty of Utrecht, a series of agreements between European powers concluding the War of Spanish Succession.

Licences to this trade were granted to the South Sea Company both before and after 1720.

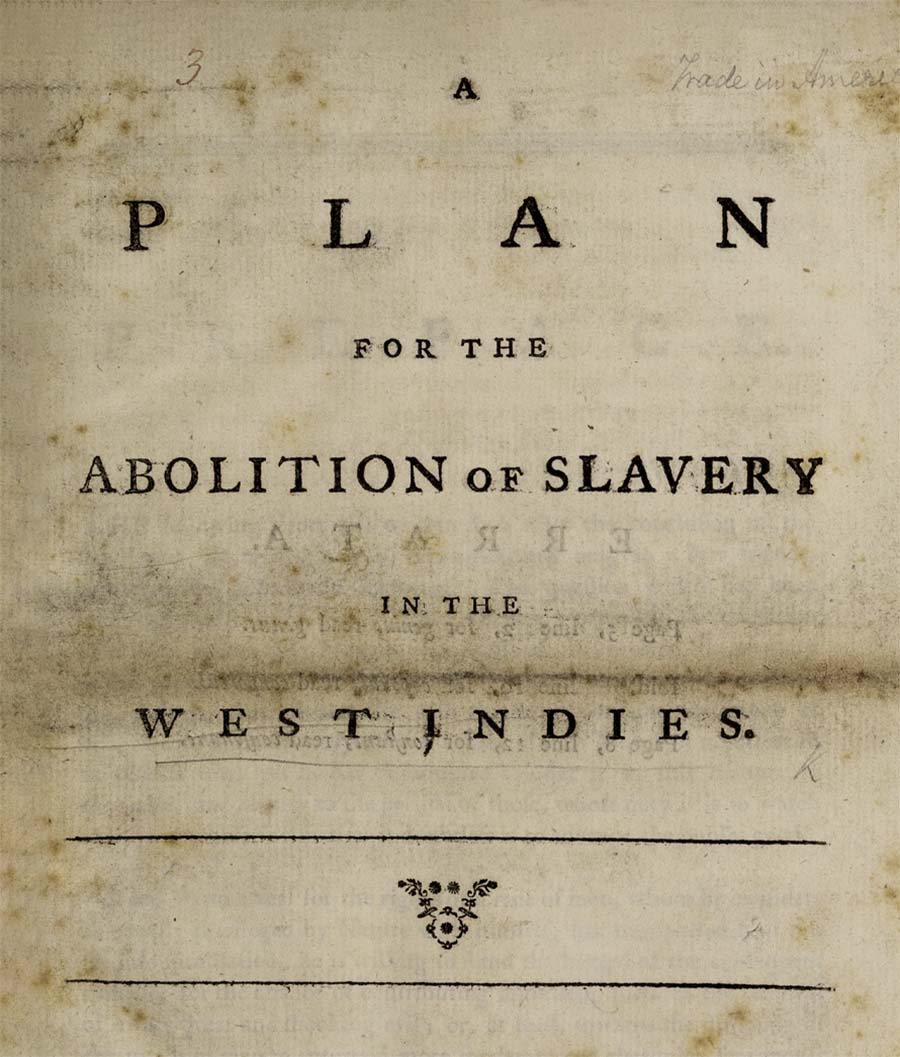

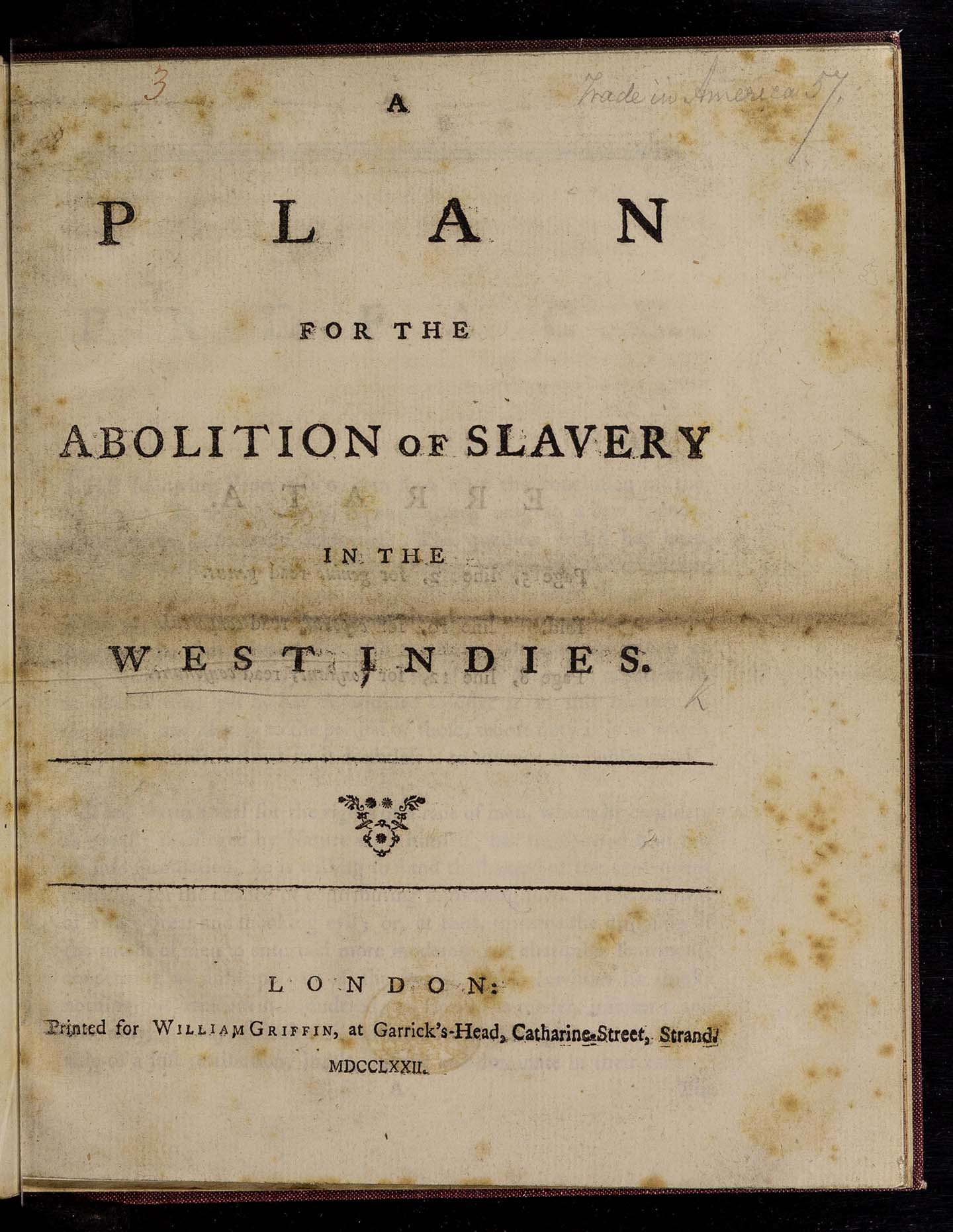

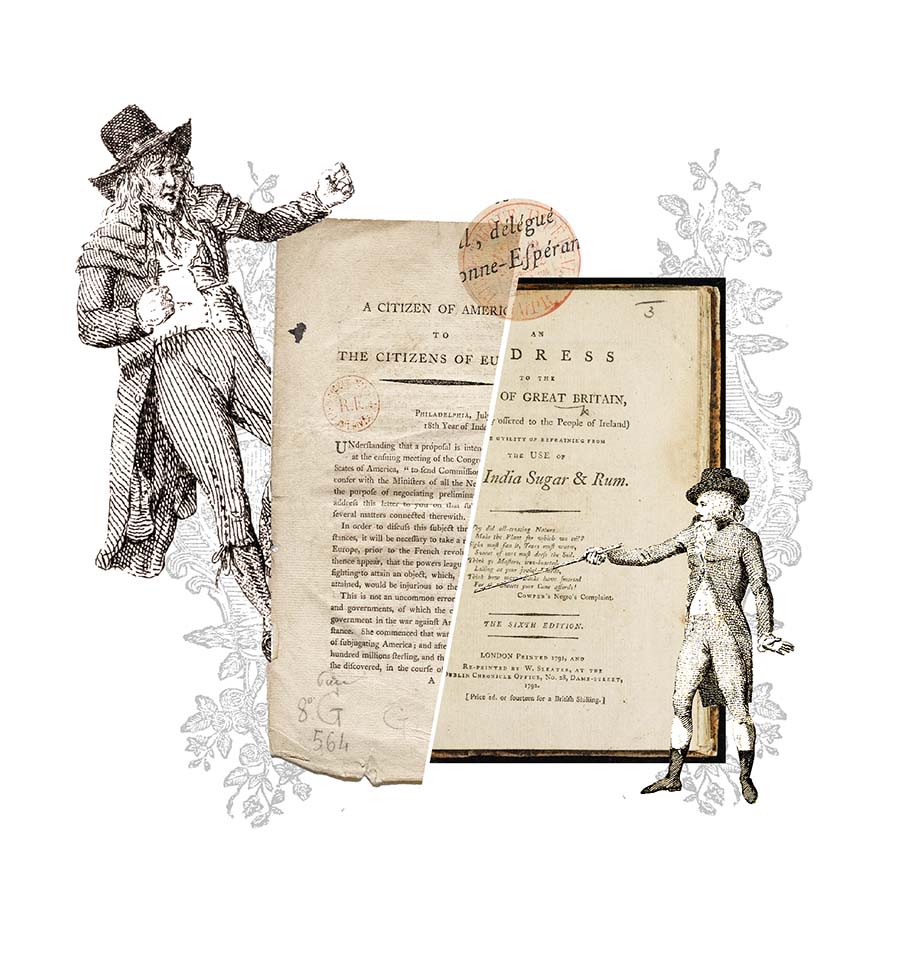

A plan for the abolition of slavery in the West Indies, London : printed for William Griffin, 1772., British Library, T42405

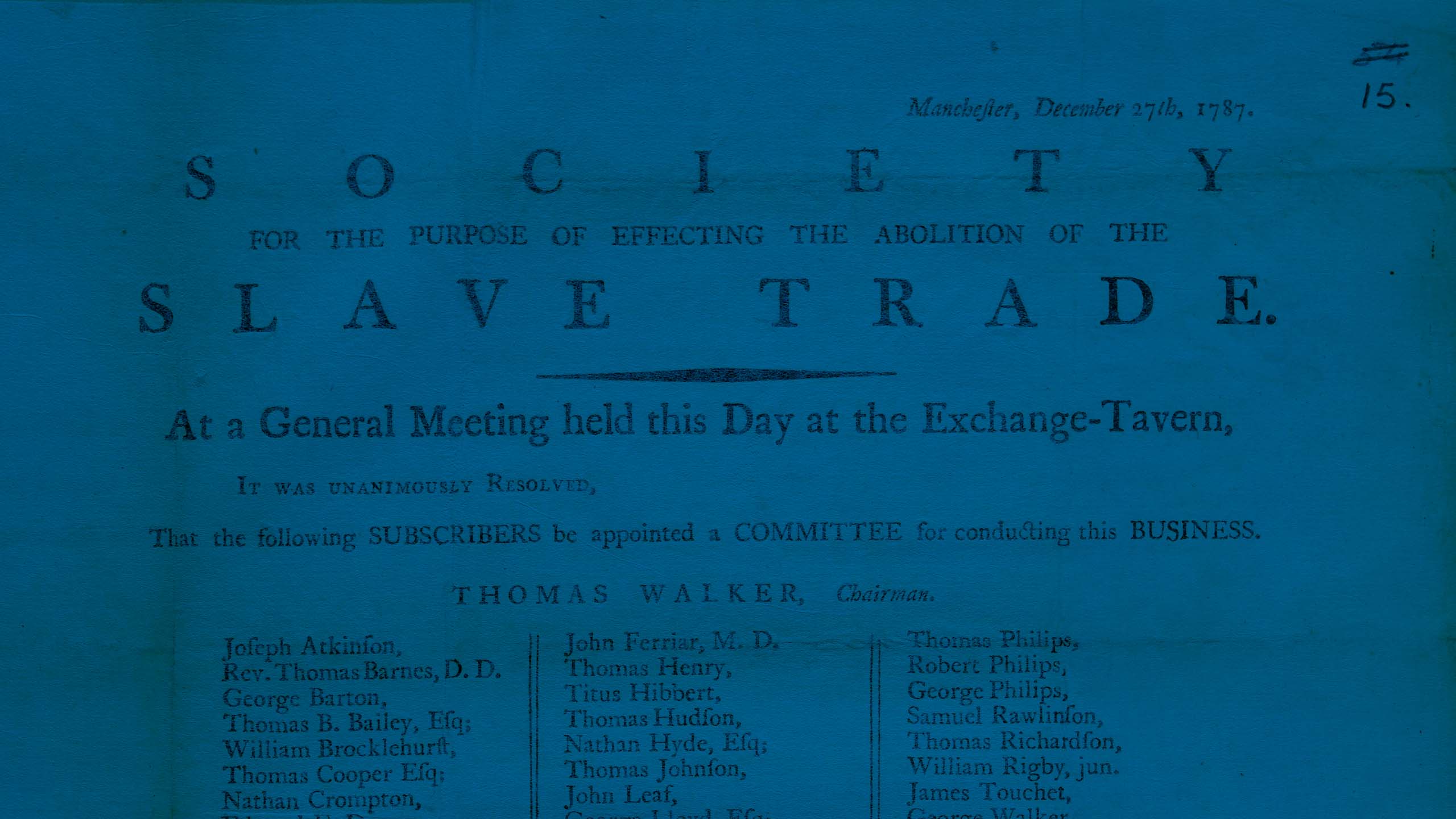

We can contrast this with the abolitionist pamphlet culture that grew throughout the century and other writings on the ‘African trade’ published contemporaneously as the abolitionist movement grew in England.

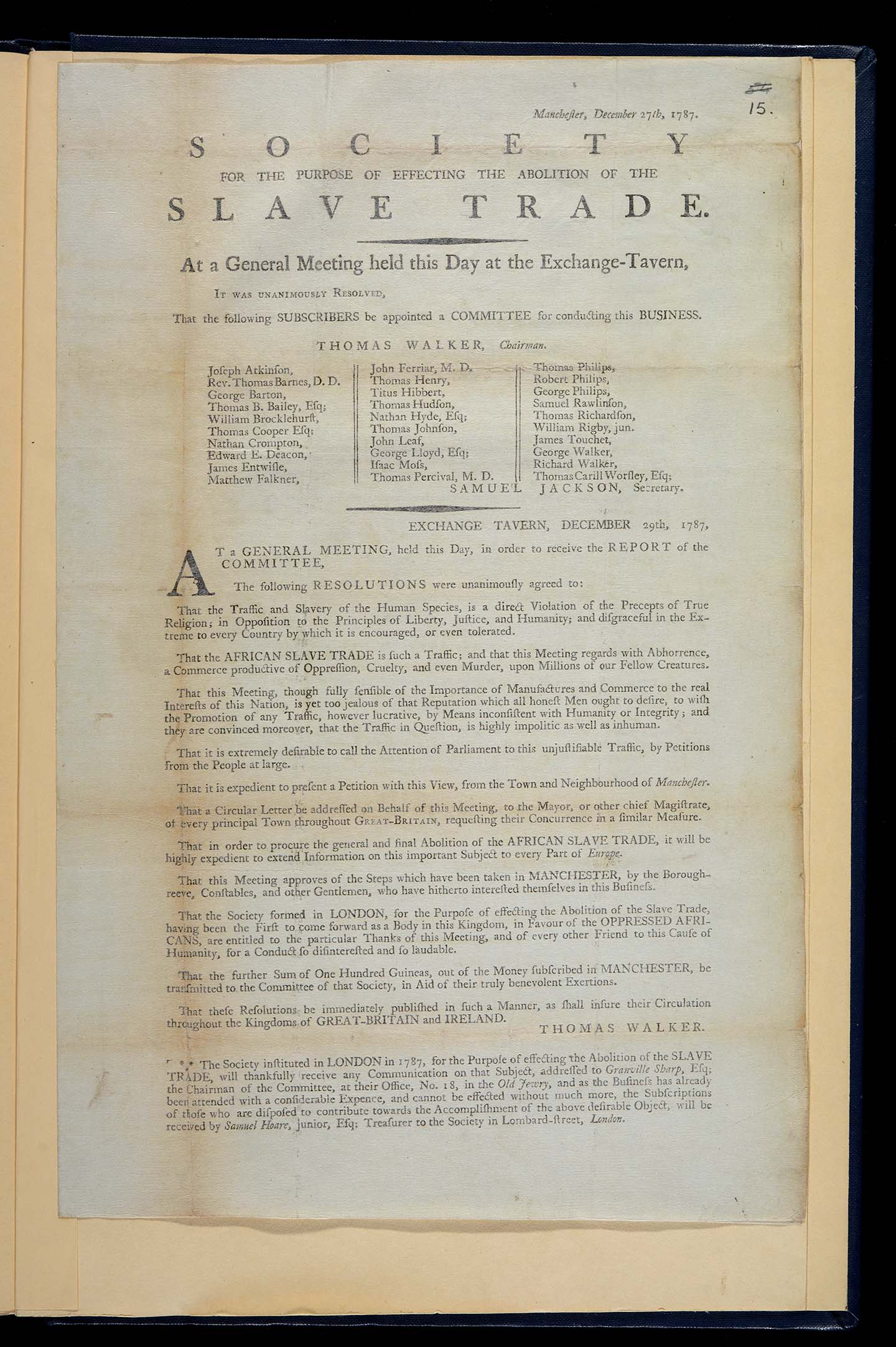

Society for the Purpose of Effecting the Abolition of the Slave Trade. At a general meeting held this day at the Exchange Tavern, Thomas Walker, in the chair, [Manchester, 1787], National Library of Scotland, N22545

Society for the Purpose of Effecting the Abolition of the Slave Trade. At a general meeting held this day at the Exchange Tavern, Thomas Walker, in the chair, [Manchester, 1787], National Library of Scotland, N22545

A plan for the abolition of slavery in the West Indies, London : printed for William Griffin, 1772., British Library, T42405

A plan for the abolition of slavery in the West Indies, London : printed for William Griffin, 1772., British Library, T42405

Number of Documents By Year, 1700-1800

◉ abolition AND slave*

Number of documents by year 1700-1800, abolition AND slave*, Gale Primary Sources

This term frequency graph shows a marked increase in documents from ECCO referencing abolition, peaking in 1792, the year in which there was a widespread boycott of West Indies sugar and hundreds of thousands of Britons signed petitions in support of William Wilberforce’s abolition bill.

New directions

With ECCO’s extensive holdings, and other Gale tools, such as the Digital Scholar Lab, scholars can dig deeper with their research to investigate and challenge traditional historical narratives.

The wide coverage of ECCO facilitates comparative investigations between different types of publication, categories of author – such as private individuals or public bodies – and differences in experience, intention and motivation of writers across the period.

Transform your studies of the Eighteenth Century with ECCO, Part III.

ECCO, the definitive collection for eighteenth-century research, is set to grow with ECCO, Part III. With 1.7 million additional pages, including rare materials never-before digitized, researchers can delve into the complexities of the eighteenth century and explore its lasting impact. Unearth maps, manuscripts, and broadsides, analyse revolutions, literature, and colonization, and uncover the connections between the past and present with this essential archive for teaching and learning.